News / Avon Pension Fund

Pension consultation to take place on arms trade investments

The Avon Pension Fund is facing growing public pressure to divest millions of pounds from companies which make weapons used by Israel in its war on Gaza.

The retirement savings of 140,000 staff, in councils, schools and other organisations, should not be invested in aerospace and defence companies, according to pro-Palestine campaigners.

But councillors on the pension fund committee were warned of the risk of divesting.

is needed now More than ever

They voted ten to three in keeping the current investment strategy on Friday.

However, this decision is only in principle, and now the fund’s members will be consulted about whether the current strategy should be kept, or if defence companies should no longer be invested in.

Several pro-Palestine campaigners urged councillors to divest from the arms trade, and one was kicked out of the meeting after shouting at councillors who had argued in favour of keeping the current strategy.

A demonstration was also held outside Bath Guildhall, before the meeting.

Toni Mayo, a children’s social worker, speaking to the Avon Pension Fund committee – photo: Alex Seabrook

Toni Mayo, a children’s social worker and member of the Avon Pension Fund, said: “For almost 20 years I’ve worked flat out in this job.

“I’ve seen many of my contemporaries and those who came after me crushed by the pain that they came across, feeling powerless within this system.

“The job has aged me and it’s haunted me, and I’m often preoccupied and stressed with my own children. I work long hours, which takes me away from them. But I do still feel that in a small way, I’m making a difference.

“We’ve lost a lot of the limited benefits of being council social workers over the last years, but our pensions remain something worth having and defending.

“The money that I have earned by trying tirelessly, at grave personal cost, to keep children safe is being used to fund the weapons that kill my brothers’ and sisters’ children abroad.

“For every day I work, I’m unwillingly contributing to genocide and war.

“I’m unwillingly complicit in the slaughter of babies, children and families all over the world, because money is being invested in the arms trade by my pension fund. In Gaza, 1,100 people have been killed in the last five days, including 400 children.

“I oppose this with every fibre of my being, as a mother, a social worker, and a trade unionist, but mostly as a human being.”

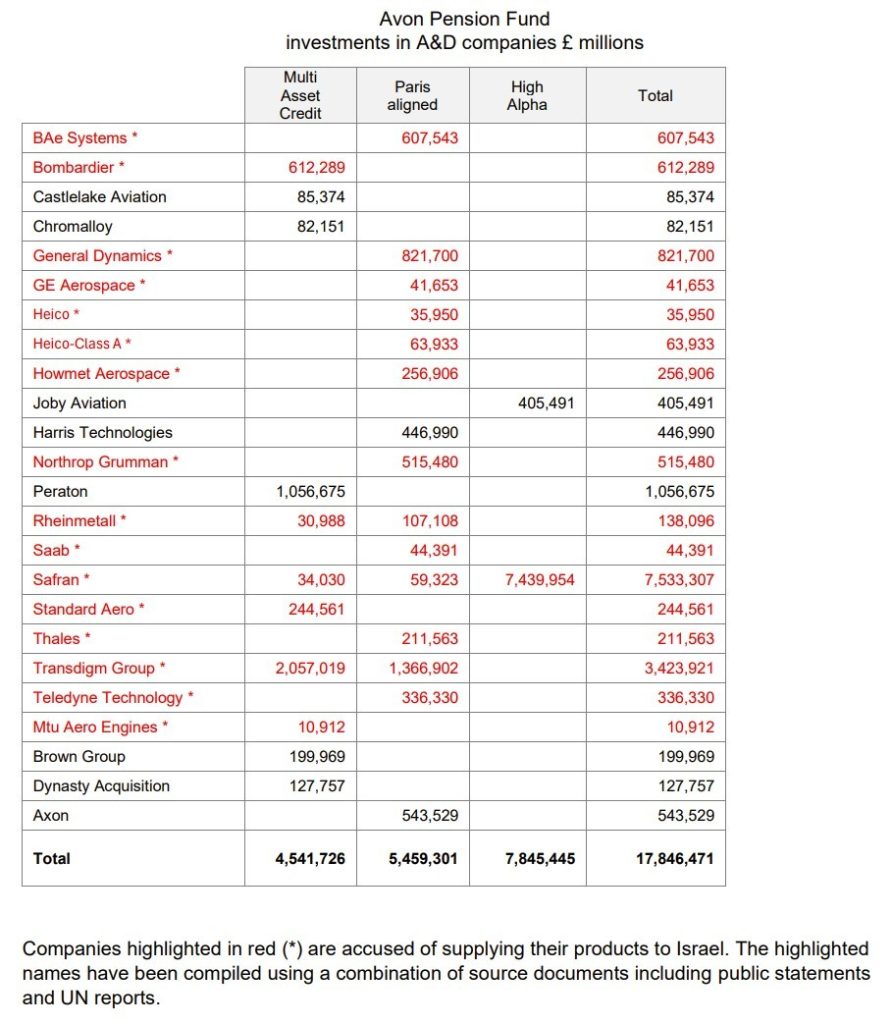

Avon Pension Fund investments in the arms trade – image: Bath and North East Somerset Council

Several trade union branches across the region, representing members of the local government pension scheme, have passed motions calling for their savings to no longer be invested in the arms trade.

Local councils too have passed motions calling on the pension fund to divest from companies making weapons used by Israel to invade Gaza.

It’s unclear when the consultation will begin, but it’s understood to be “as soon as possible”.

However the fund’s committee was told that changing its investment strategy based on one particular conflict would be hard to defend legally.

Instead, a more defensible option would be to stop investing in all arms companies, according to Nick Dixon, head of pensions at the fund.

But this would include firms that employ thousands of people in the region, as well as supply Ukraine with weapons to defend against the Russian invasion.

Two firms, Lockheed Martin and RTX, are already excluded from investments on ethical grounds.

Liberal Democrat councillor Toby Simon, who voted in favour of the status quo, said: “We have government licensing on exports to Israel, which have been clamped down in light of the Gaza conflict.

“We are left with a core of armament and defence companies which help to supply our own defence and that of our immediate neighbours.”

Green councillor Fi Hance, who voted against, added: “The cost of removing our investments in the aerospace industry is negligible in percentage terms.

“On the employment issue, I feel that it’s analogous to the tobacco industry, which clearly we would not invest in, and which was formerly a massive employer in the area.”

The Avon Pension Fund invests £6bn on behalf of staff at 450 employers, including local councils and schools. At the moment, £18m of this is invested in arms companies.

Divesting would involve setting up a bespoke passive pool of shares in companies, which would cost an estimated £1m a year due to the extra costs paid to asset managers.

After the meeting, councillor Hance said: “I’m disappointed that the preferred view of the committee as voted through today is to consult on the status quo rather than support divestment from the arms industry but I trust that the views of all of our members are respected and listened to.

“My personal view is that arms investment is hard to justify on moral or environmental grounds but it is the members who will have the final say on this

“When I joined the committee I was told that the Avon Pension Fund is one of the good guys.

“We may be one of the first councils to stick our head over the parapet over this so I’d like to think that as one of the good guys we can attempt to draw something faintly positive out of the many terrible conflicts that have erupted in recent months.

“It’s disappointing that the clear views of Bristol and Bath councils in passing motions, along with those of several unions, appear to have been set aside.”

The Avon Pension Fund doesn’t manage its investments directly.

These are held in the Brunel Pension Partnership, which invests in many different companies across the world. After the consultation, the committee will then make a final decision regarding investing in the arms trade.

Liberal Democrat councillor Paul Crossley, chair of the pension fund committee, added: “We heard 11 moving and powerful petitions today, and we thank everyone who shared their views. We’ve thoroughly reviewed our investments in aerospace and defence and explored two practical options.

“At the end of the debate ten committee members voted to continue investing in aerospace and defence, and three voted to divest.

“Now that the committee has made a decision in principle, we will consult our members, which will inform the committee’s final decision. We will report on the members’ views in public as soon as practical in 2025.

“We will also focus on ensuring our existing exclusion policy, introduced in 2024 to protect human rights, continues to be robustly implemented by our fund managers, who will continue to engage aerospace and defence companies.

“We remain committed to ensuring our investments address a broad range of environmental, social and human rights issues, and to engaging with our many stakeholders.”

Main photo: Alex Seabrook

Read next:

Our newsletters emailed directly to you

Our newsletters emailed directly to you