News / great western credit union

Credit union to offer competitive saving options as base rates lowered

A credit union founded in Bristol, which celebrated its 25th anniversary last October, is stepping up to “offer some of the best savings deals in the South West”, following Bank of England’s recent decision to lower the base rate.

Great Western Credit Union (GWCU) is showcasing two key savings accounts: the Fixed Rate Saver and Money@Work, that are proving to be valuable tools for savers looking to maximize their returns.

The Fixed Rate Saver, now offering a competitive 4.75 per cent AER/gross (the interest rate on savings before tax deductions), has become a standout option for those seeking a secure, fixed return.

With interest rates continuing to decline across many savings accounts, GWCU’s offering stands out as a beacon for savers looking to lock in a guaranteed rate.

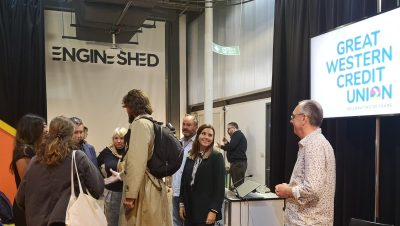

James Berry, chief executive of GWCU, highlighted the importance of securing competitive returns in a time of fluctuating rates – photo: Milan Perera

Savers can deposit between £1,000 and £80,000, with the offer available until March 7, or until fully subscribed. Interest will be added at maturity on March 6, 2026, making it an ideal option for those looking for a safe, long-term investment.

Meanwhile, the Money@Work savings account is making a big impact among new employee savers, offering an exclusive 7 per cent AER. This deal is available to employees of partner organizations who sign up before the end of March.

The credit union believes that these offerings not only help individuals grow their savings, but they also supports local businesses by providing valuable financial wellbeing benefits to their workforce.

James Berry, chief executive of GWCU, highlighted the importance of securing competitive returns in a time of fluctuating rates. He said: “As the Bank of England lowers the base rate, securing a competitive return on savings is more important than ever.

“Our Fixed Rate Saver and Money@Work savings scheme offer some of the best rates available, ensuring our members can make the most of their money while also supporting their local community.”

Great Western Credit Union (GWCU) has recently celebrated its 25th anniversary – photo: Milan Perera

In addition to offering competitive rates, all GWCU savings accounts are covered under the Financial Services Compensation Scheme (FSCS), protecting deposits up to £85,000, providing savers with peace of mind that their money is safe.

For more information, visit www.greatwesterncu.org/savings

Main photo: @JonCraig_Photos

Read next:

Our newsletters emailed directly to you

Our newsletters emailed directly to you